June 06, 2019

3676

In recent years, the semiconductor industry has been surging. On the one hand, China's semiconductors have sprung up. On the other hand, the global industry is facing a super cycle, coupled with the rise of emerging applications such as artificial intelligence, the friction between China and the United States, and the current status of global semiconductors. What about the opportunities for global semiconductors?

The past and present of semiconductors

1. History of semiconductors

A chip is a miniature electronic device or component. A certain process is used to interconnect components, such as transistors, resistors, capacitors, and inductors, which are required in a circuit, on a small or small piece of semiconductor wafer or dielectric substrate, and then packaged in a single package. It becomes a micro-structure with the required circuit function; all the components are structurally integrated, making electronic components a big step toward miniaturization, low power consumption, intelligence and high reliability.

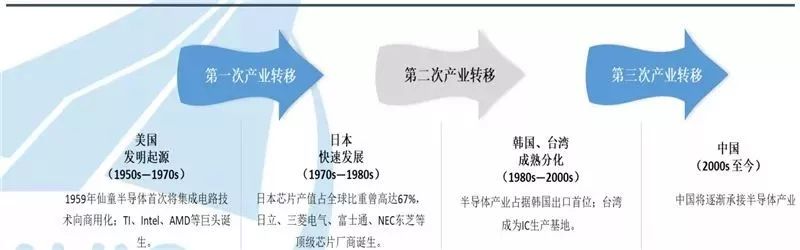

Since Texas Instruments invented the world's first integrated circuit in 1958, the number of integrated circuits has developed rapidly, and historically it has shifted from the west to the east. Since the development in the 1950s, integrated circuits have undergone three major industrial changes, namely: Inventing the origins in the United States - accelerating development in Japan - Differentiating and developing in South Korea and Taiwan.

▲ Three changes in the global semiconductor industry

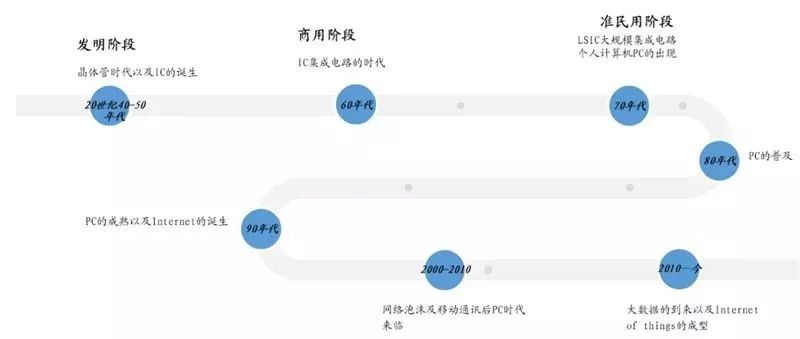

Through the timeline of the development of the global semiconductor industry, seven time nodes can be divided: the transistor era and the birth of IC in the 1940s and 1950s; the IC manufacturing industry entered the mass production stage in the 1960s, IC entered the commercial stage; Computers appeared, large-scale integrated circuits entered the civilian field; PCs became popular in the 1980s, and the whole industry was basically developing around PCs; in the 1990s, PCs entered a mature stage; in the first 10 years of the 21st century, the Internet was widely promoted, and the era of network bubbles and mobile communications came. The replacement of PC by consumer electronics has become a new driving factor in the semiconductor industry. Since the advent of the big data era from 2010 to the present, the semiconductor industry has experienced a slowdown in growth and gradually matured.

▲ Global semiconductor industry development process

2, semiconductor industry chain panorama

Semiconductors are the core of many industrial devices, and are widely used in core areas such as computers, consumer electronics, network communications, and automotive electronics. Semiconductors are mainly divided into four parts: integrated circuits, discrete devices, optoelectronic devices, and micro-sensors, in which integrated circuits can be divided into microprocessors, logic ICs, memories, and analog circuits according to their functions. Among them, integrated circuits account for more than 80% of the entire market, and can be divided into computing, storage and analog integrated circuits according to their functions.

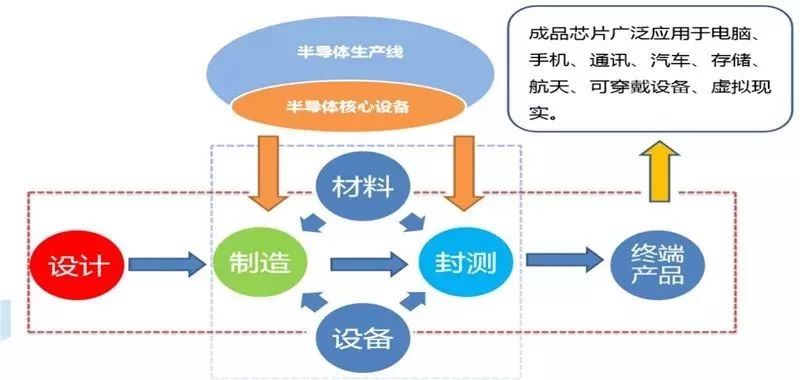

Simplifying the entire semiconductor production process, we can draw the following figure, the chip is mainly experienced in the design, manufacturing stage, packaging and testing, and finally flow to the terminal product field.

▲ semiconductor production process

The semiconductor industry chain is large and complex, and can be divided into upstream support industry chain, including semiconductor equipment, materials, production environment; midstream core industry chain, including IC design, IC manufacturing, IC packaging and testing; downstream demand industrial chain, covering automotive electronics, consumption Electronics, communications, computers. From the perspective of companies distributed in the industrial chain: the United States, Japan, Europe, and Taiwan companies form a complete coverage of the core industries of the upper and middle reaches, and rely on technology to control the monopoly of the semiconductor industry.

▲Semiconductor industry chain panorama

From the global integrated circuit market, as the PC application market shrinks, the 4G mobile phone market is gradually saturated, and the global integrated circuit market is slowing down. However, global integrated circuit sales still maintained 15.94% growth in 2018, reaching 477.936 billion US dollars. . From 1999 to 2018, global semiconductor sales increased from US$149.4 billion to US$477.936 billion, with a compound annual growth rate of 6.31%.

According to data from Gartner, Samsung Electronics and Apple are still buyers of two major semiconductor chips in 2018, accounting for 17.9% of the global market, down 1.6% from the previous year. Driven by increased shipments and average sales prices, Intel's semiconductor revenue last year increased by 13.8% compared to 2017. In addition, other major memory chip makers also performed strongly last year, including SK Hynix and Micron.