April 21, 2021

2196

The European electronics industry directly affects Europe's 3.8 trillion Euro GDP.

A new IPC study "Digital Direction, Green Connection" in April found that the electronics manufacturing industry has largely withstood the negative impact of the COVID pandemic and is expected to help promote the recovery and resilience of the European economy, especially in In the case of expected government decision-making to adopt supportive measures.

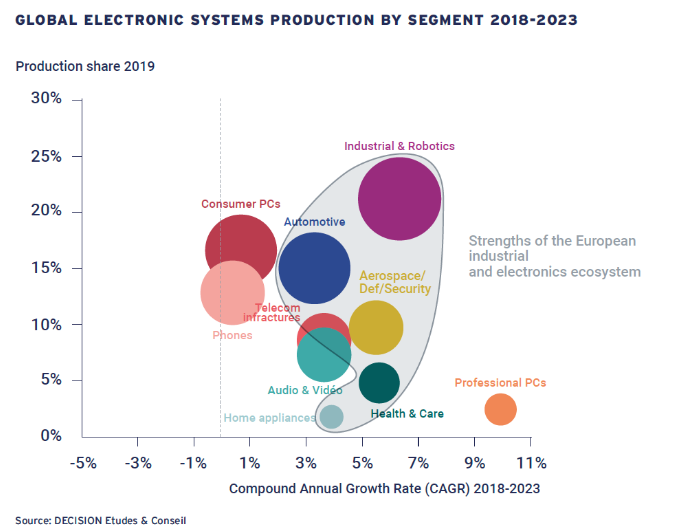

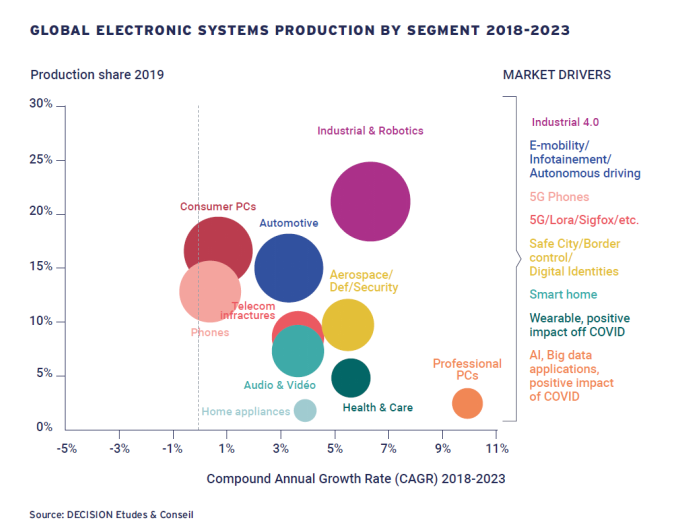

The study emphasized the importance of electronic systems, especially those embedded in end-user electronics, from industrial robots to Airbus A350 to 5G infrastructure, which are the main driving forces of global GDP growth. The report predicts that during the period 2018-2023, the global compound annual growth rate of the industry will be 3.7%, while the World Bank predicts that the overall global growth rate will be 1.8% during the same period. As Europe transitions to a digital economy and a green economy, its electronics manufacturers will usher in strong growth after years of decline in global market share.

This research was commissioned by Decision Etudes & Conseil, the Global Electronics Manufacturing Association IPC, and includes a detailed analysis of Europe’s advantages and challenges in this vital industry, as well as government policies to improve Europe’s resilience and competitiveness in this industry Suggest.

“Although this pandemic has knocked down many industries, data shows that the electronics manufacturing industry will become a key industry to promote the recovery of the European economy and meet future market needs. Alison James, IPC Senior Director of European Government Relations said: “For transportation, industry For key mission sectors such as equipment, aerospace and defense, IT and telecommunications, and healthcare, if they want to rebound from the pandemic and move toward the future, they will need government policies to strengthen the resilience of the entire electronics manufacturing industry. "

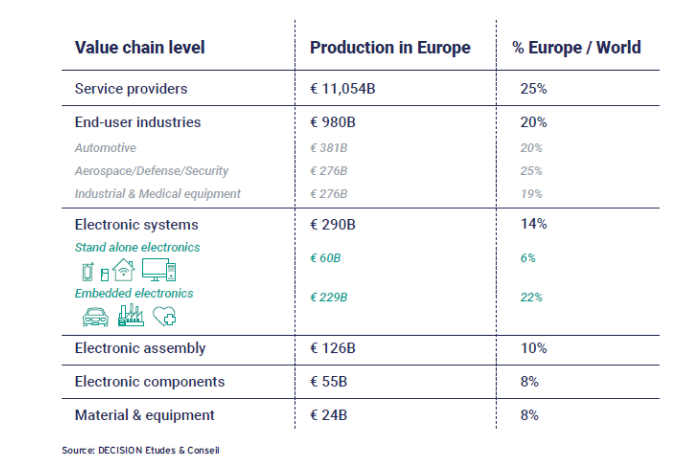

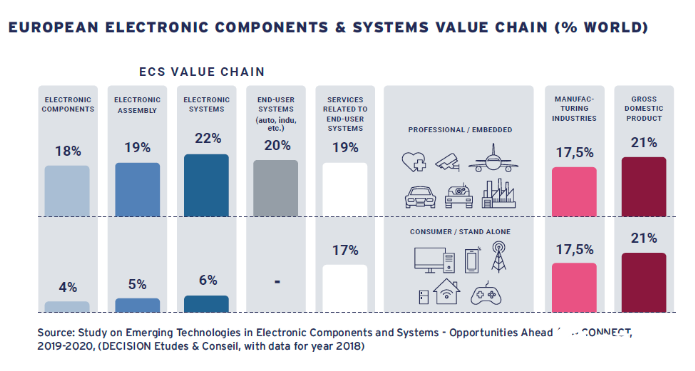

The study emphasized that the output value of the electronics manufacturing industry in 2019 was 301 billion euros, which directly affected the European GDP of 3.8 trillion euros. However, the study also shows that the European Union now accounts for only 5% of the total global printed circuit board (PCB) production and about 10% of the global electronic manufacturing services (EMS), and EMS is a key element of the electronic manufacturing ecosystem.

This study was conducted at the time of the key decision of the European Commission (EC), which will release a revised industrial policy strategy later this month; capitals are also developing COVID recovery plans to gain potential for EC financial support. The momentum to invest in next-generation processors and semiconductor technology is also increasing. The EU's recovery and resilience mechanism will provide 672.5 billion euros in loans and grants to support reforms and investments in member states, 20% of which will be used to promote digital transformation. Member states will submit their spending plans by the end of this month.

"This report strongly demonstrates the holistic policy approach taken to the electronics manufacturing industry as the EU seeks to revive economic growth, advance digitalization and green transformation." James said: "There are now a series of opportunities to adjust policies and partnerships. And investment to achieve these goals."

To support the electronics manufacturing industry, the report made a series of recommendations, including:

· Regard electronics manufacturing as an industry of strategic importance and invest in neglected parts of the value chain. Although people generally recognize the strategic importance of semiconductors and microelectronics, the report pointed out that progress also depends on investment in PCB and electronic board assembly manufacturing. When the government invests in microelectronics, a gap analysis should be conducted to assess the corresponding needs of PCB manufacturing and assembly. These sectors should also benefit from specialized funding initiatives, such as recovery and resilience funds.

· Support European manufacturers to transform into factories of the future, strengthen industry development and promote digital transformation. Since most European PCB and EMS companies are small and medium-sized enterprises, they especially need investment support in R&D, equipment upgrades and employee training to create more interconnected and more efficient factories in the future.

· Strengthen vocational training and lifelong training. The European Convention on Microelectronics Skills was launched in 2020, and the goal is to have a total public and private investment of 2 billion euros by 2025 to improve and retrain the skills of more than 250,000 workers and students. Here, the report again recommends that PCB manufacturers and assemblers be included in these plans, and that member states’ recovery plans should include projects dedicated to improving Industry 4.0 tools and technical labor skills, with special attention to small and medium-sized enterprises.

· Focus on Europe's leading position in embedded electronic products (accounting for 85% of its electronic product output) to help achieve a successful green and digital transformation. Supporting these end-user sectors will help drive overall growth and lead to cleaner, more connected, and more autonomous vehicles and smarter, safer, and more efficient homes, factories, and healthcare systems.

· When defining the concept of “open strategic autonomy” in Europe, strike a careful balance between supporting regional production and a flexible global supply chain. This includes working with like-minded partners at the multilateral and bilateral levels to enforce trade rules and avoid creating new trade barriers.