May 20, 2021

2617

News on May 20 IC Insights updated its forecast for 33 major IC product categories in its "McClean Report-Comprehensive Analysis and Forecast of the Integrated Circuit Industry (MR21)" updated in April.

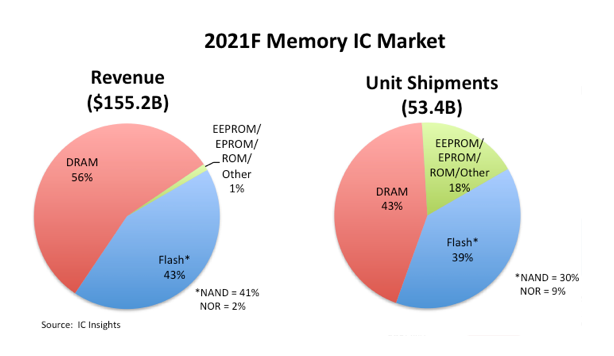

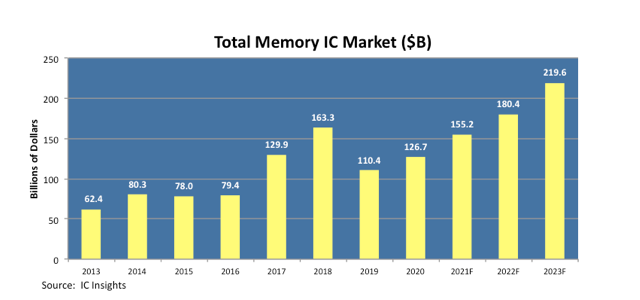

The latest forecast shows that after a sharp decline in 2019, memory chip sales will rebound by 15% during the 2020 new crown epidemic. After that, the increase in DRAM pricing is expected to increase total memory revenue this year by 23% to US$155.2 billion. The average selling price of DRAM increased by 8% in the first quarter of this year. Almost all major memory suppliers stated in their most recent quarterly financial reports that they expect stronger demand in the second quarter of 21.

It is predicted that the rebound in memory sales will continue until 2022, when total memory sales are expected to increase by 16% to US$180.4 billion, which will break the peak of the previous memory cycle, setting a record high of US$163.3 billion in 2018. The memory market is expected to reach the peak of the next cycle in 2023, when revenue will grow to nearly 220 billion U.S. dollars—breaking through the 200 billion U.S. dollar sales level for the first time, and then return to a cooling-off period in 2024. IC Insights predicts that from 2020 to 2025, the entire memory market will grow at a compound annual growth rate of 10.6%.

By 2021, DRAM is expected to occupy 56% of the memory market, and flash memory will occupy 43% of the market. DRAM is expected to account for most of the storage unit shipments this year. Although other memory products (EEPROM, EPROM, ROM, SRAM, etc.) are still a viable market, it is unlikely that these market segments will account for more market shares than they currently do.