August 24, 2020

2327

"From 2013 to 2018, we have seen the market growth that has just started," Wood Mackenzie Power & Renewables research director Ravi Manghani explained, "Although the deployment scale of energy storage during this period is about 7 GW / 12 GW However, the compound annual growth rate during this period was as high as 74%."

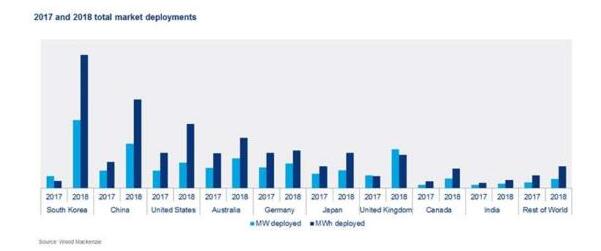

"Nevertheless, these developments have changed the thinking of global regulators, policymakers, grid operators, asset operators, and developers, especially in terms of how the energy system is balanced," Manghani continued. "The market structure is generally Strive to keep up with this technology, during this period, more than half of the energy storage deployments went live in 2018."

Due to the installation of 3.3 GW/6 GWh of new capacity, energy storage increased the most in 2018, with a year-on-year increase of 140%.

Looking to the future, Wood Mackenzie predicts that the energy storage market will gradually mature and grow at a compound annual growth rate (CAGR) of 38%, with the deployment number of 63 GW / 158 GWh.

Due to strong market reforms and national laws, the United States and China have unsurprisingly taken the lead, accounting for 54% of the deployment scale in 2024.

"We expect that renewable energy projects will become a popular trend in future energy development," said Rory McCarthy of Wood Mackenzie Power & Renewable Senior Research Analyst. "This is especially true for solar storage projects, because the demand for clean and dispatchable renewable energy is widely accepted. ."

In terms of investment, the cumulative global energy storage market is expected to grow sixfold by 2024, reaching 71 billion U.S. dollars, and 14 billion U.S. dollars will be invested in 2024 alone. The electrification era will unfold faster in the next five years. With it, energy storage will become a necessary technology to improve system flexibility and achieve clean and rapid system balance, while reducing the risk of increasing intermittent assets and investment portfolios.