Published :5/21/2021 10:14:27 AM

Click Count:2103

In recent years, there have been frequent mergers and acquisitions in the semiconductor market. Recently, there have been media reports that STMicroelectronics intends to acquire its competitor Nordic Semiconductor, and the two parties have entered the preliminary negotiation stage. Affected by this, Nordic shares rose 11%.

Nordic is a fabless semiconductor company that specializes in developing wireless technologies that provide technical support for the Internet of Things. Focusing on the BLE market, it also launched products such as ANT+, Bluetooth mesh, Thread, and ZigBee. Especially in the BLE market, Nordic has become a well-deserved leader.

According to the data research company TSR report, in 2018, the global BLE company's market share, Nordic occupied the top% of the list with a 40% share, followed by Dialog (11%), TI (10%), ST (7%) )Wait. At the same time, according to SIG's data, Nordic far exceeds its peers in BLE terminal product certification, and the share of serious terminal products in the second quarter of 2020 will reach 46%.

To give an intuitive example, we can see how powerful Nordic is in the BLE market. According to data comparison, in 2018, Nordic’s one-year revenue in the BLE market has reached about half of the total revenue of domestic BLE manufacturers in China, far exceeding second.

At the same time, Nordic is also accelerating the layout of the industrial chain, including investment in networking protocols, the horizontal development of 2.4G product lines, and complementing the 2.4G target chips for the high, middle and low segments of the market. Deploy LTE-M and NB-IoT long-distance network access to integrate home mesh network and local area network; provide a complete Internet ecological chain company BLE transmission protocol, etc.

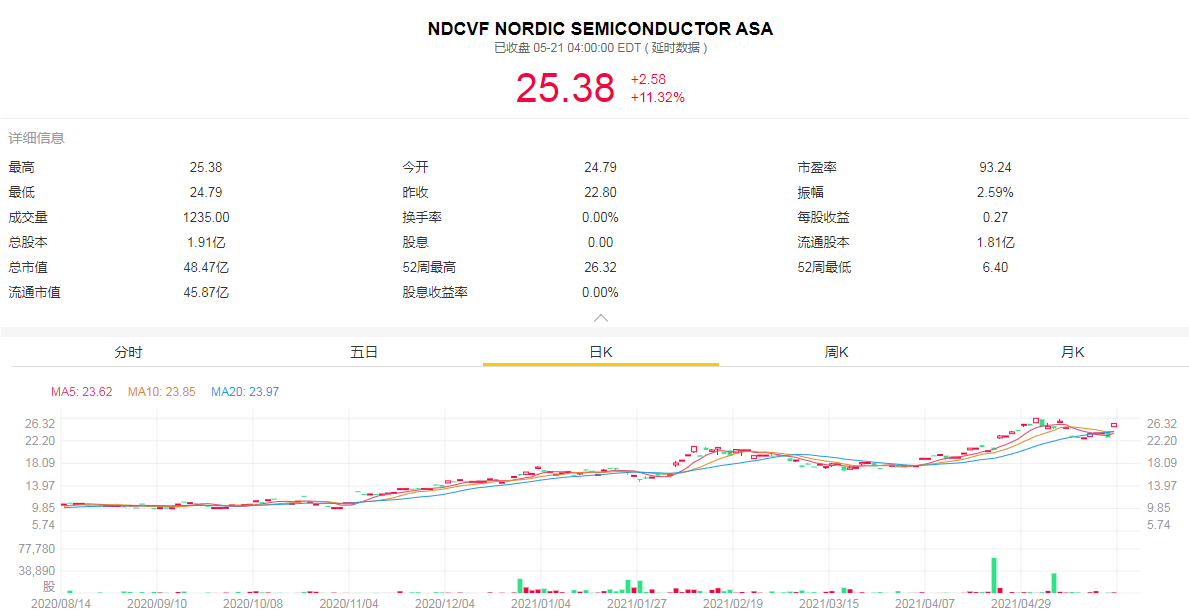

Strong technical capabilities, coupled with a high market share, make Nordic's performance in the stock market outstanding. As a company listed on the Oslo Stock Exchange in Europe, in the case of a weak European market, Nordic share price Instead, it has gone up all the way, and has now reached a relatively high level in history.

Nordic stock price trend|Tiger Securities

When the news that ST wanted to acquire Nordic came out, Nordic's stock price rose by 11% that day, but before that Nordic's stock price has continued to rise for about a week, and the total market value is close to 5 billion US dollars.

Nordic is like a piece of sweet pastry for a major semiconductor manufacturer, and it can be expected to be acquired. Nordic has become the only semiconductor company headquartered in Europe. During the same period, startups such as Ember and Dust Networks have been scraped off by Silicone labs and Linear Technology. However, Nordic has developed rapidly and has not only achieved the global BLE market. At the same time, it also has the world's most powerful BLE protocol stack development team.

For semiconductor giants, European semiconductor companies are nothing more than gourmet food on the table, especially for companies with strong strengths in the subdivision field, they are even more attractive to semiconductor giants. Once Nordic is included in the bag, it will undoubtedly greatly enhance the company's strength in the BLE field and even the IoT field.

In the past few years, mergers and acquisitions in the semiconductor field have been frequent, but most of them are concentrated in small companies. By 2013, private semiconductor companies have almost exhausted their funds. Therefore, if there is no merger, the more funds will win, the winner takes all, and the big Evergrande, large-scale semiconductor mergers and acquisitions have begun to increase.

At present, mergers and acquisitions of large semiconductor companies are no longer just for the purpose of exerting economies of scale or just focusing on immediate revenues, but to create future competitiveness in the Internet of Things, autonomous driving, artificial intelligence and other fields, and to lay out future business growth points. Looking back at the large-scale semiconductor mergers and acquisitions in recent years, it is nothing more than the same.

At the same time, some people in the industry revealed that ST's only loss-making project is in the wireless product line. Obviously ST has the motive to acquire Nordic.

However, some analysts pointed out that although from a strategic point of view, the acquisition of Nordic can strengthen the advantages of STM's positioning in the IoT field, and IoT is one of the market segments with the fastest growth expected in 5G development. However, preliminary analysis shows that this transaction is difficult to create value for STM, because: assuming that the synergy is equivalent to 10% of Nordic’s revenue (about 60% of eBIT), analysts believe that the net present value will be slightly lower than the bid reason. The required 30% premium.

Paal Elstad, Nordic's chief financial officer, responded to this and said that he had no knowledge of ST's acquisition of Nordic. ST also declined to comment on this.