Published :6/4/2019 9:47:56 AM

Click Count:2103

On the evening of May 29, 2019, Marvell announced that it would sell its Wi-Fi and Bluetooth chip portfolio business to NXP for $1.76 billion. The business unit has approximately 550 employees and generated approximately $300 million in revenue for Marvell in FY 2019. NXP expects to double its revenue by 2022.

The two companies said the acquisition will be completed by the first quarter of 2020.

On the evening of May 29, 2019, Marvell announced that it would sell its Wi-Fi and Bluetooth chip portfolio business to NXP for $1.76 billion. The business unit has approximately 550 employees and generated approximately $300 million in revenue for Marvell in FY 2019. NXP expects to double its revenue by 2022.

The two companies said the acquisition will be completed by the first quarter of 2020.

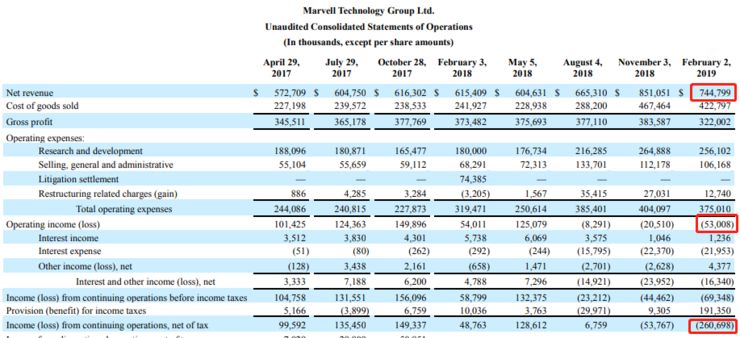

In March 2019, Marvell announced its Q4 financial results for the fiscal year ending February 2, which generated revenue of $745 million, an operating loss of $53 million, and a net loss of $260 million.

In order to get rid of the lower-margin product line, Marvell chose to sell Wi-Fi and Bluetooth business at this time strategically, although connectivity is one of its core businesses.

In addition, Marvell announced earlier this month that it has acquired cable network company Aquantia for $452 million. Last week announced the acquisition of GlobalFoundries subsidiary Avera Semiconductor for $650 million to enhance Marvell's ability to develop 5G mobile networks and cloud data centers.

In view of this, the sale of connected businesses at this time is indeed beneficial to offset the cost of Marvell's large-scale acquisition.

Have to say "epic-level" mergers and acquisitions

Speaking of the merger of NXP and Marvell, you have to mention the "epic-level" merger between NXP and Qualcomm.

At the end of 2015, after acquiring Freescale, a semiconductor company primarily targeting the automotive sector, for $11.8 billion, NXP became the world's largest manufacturer of automotive semiconductors.

In October 2016, communications chip giant Qualcomm announced for the first time that it would acquire NXP for $47 billion, setting a record for Anwar's $37 billion acquisition of Broadcom in 2015, making it the largest acquisition in chip history.

Qualcomm CEO Steve Mollenkopf said: The largest M&A case in the chip industry will accelerate Qualcomm's entry into the emerging automotive electronics market. We are committed to integrating the products of the two companies and ensuring a balance between the representatives of the two companies in the management.

The outside world also believes that the cooperation between the two sides must be a typical strong alliance. Qualcomm can access NXP's resources in the areas of Internet of Things, automotive chips, security systems, etc., especially in the case of saturation of the smartphone market, this acquisition will help Qualcomm to disperse products and revenues are too concentrated.

NXP has not invested a lot of time and energy into the wireless transmission business, and this aspect is the advantage of Qualcomm.

Regrettably, this "epic-level" merger has not only faced the pressure of internal shareholders, but also experienced anti-monopoly review in nine countries. After a wave of volatility, Qualcomm and NXP cleared the eight “barriers” on the merger road and finally failed to obtain approval from the Chinese Ministry of Commerce.

The "epic-level" acquisition ended with Qualcomm paying NXP a $2 billion liquidated damages.

The "sorry" of NXP and Qualcomm is compensated by Marvell

For NXP, after missing the merger with Qualcomm, Marvell may be the best choice for making up for his shortcomings.

According to foreign media reports, Marvell began to enter the wireless connection market in 2002 to develop Wi-Fi technology. In nearly two decades of hard work, Marvell's connectivity team has been a pioneer in providing innovative, secure and reliable Wi-Fi and Bluetooth combo solutions.

For this acquisition, the CEOs of the two companies also voiced separately.

NXP CEO Rick Clemmer said: In order to provide customers with better solutions, this acquisition plays a very important role, because our customers have been urging us to add connectivity to the product, and the value of the Marvell division is reflected in this.

In recent years, due to the increase in labor costs and the slowdown in process improvement, major chip manufacturers have considered simplifying industrial structures and product lines through mergers and acquisitions to provide solutions for cost and technology.

NXP did not catch the Qualcomm communication technology, but it did not miss Marvell.

While $1.76 billion is "very expensive," Wi-Fi is still the primary means of connecting industrial applications and the Internet of Things in a short period of time. In addition, the acquisition will increase NXP's market share and increase Marvell's gross margin and operating margin.

Why not do the best of both worlds?